Note: if you are reading this as a part of quick-start guide and are eager to try to connect MockBank with your application - you can just read the “Customers” section and skip the rest. |

Within the admin-console you can:

manage customers

accounts

transactions

transaction rules

If you are your organisation’s admin - you can also manage users.

Customer models banks customers - people who have bank accounts, username and password and can login to online banking and pay the bills with bank transfers.

We have added a “default” customer with an account and transactions when you have registered. If you want to quickly try to integrate MockBank - just grab username and password on the customer list screen and go to https://jrholding.atlassian.net/wiki/spaces/MPD/pages/685834241/Connect+MockBank+via+finAPI |

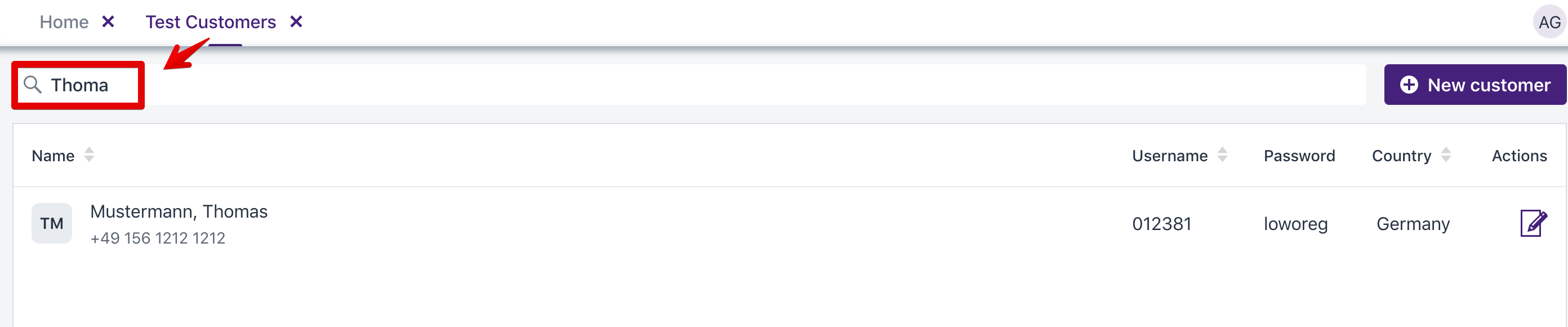

With customers overview you can quickly find customer you are looking for.

To find someone even quicker - use search.

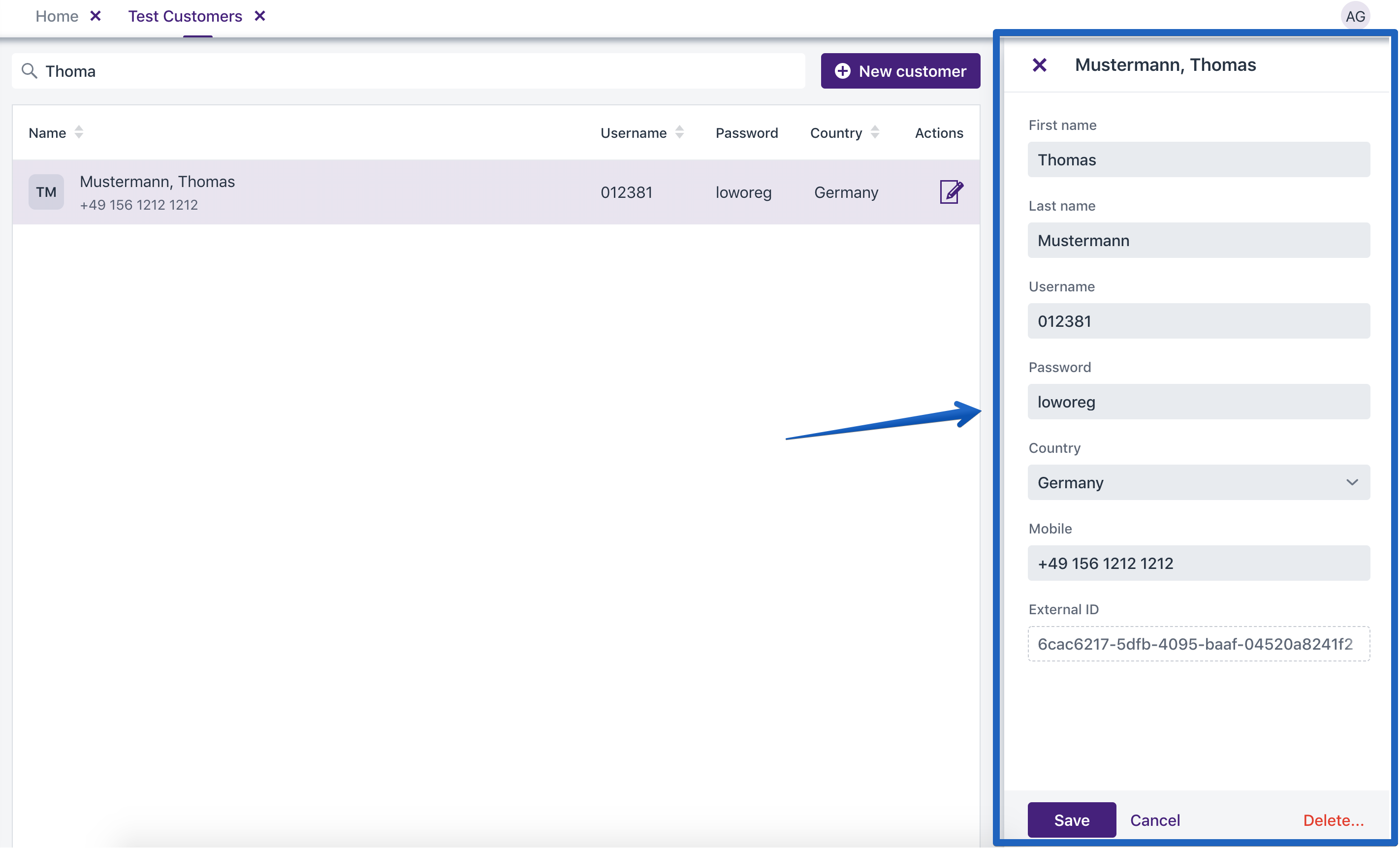

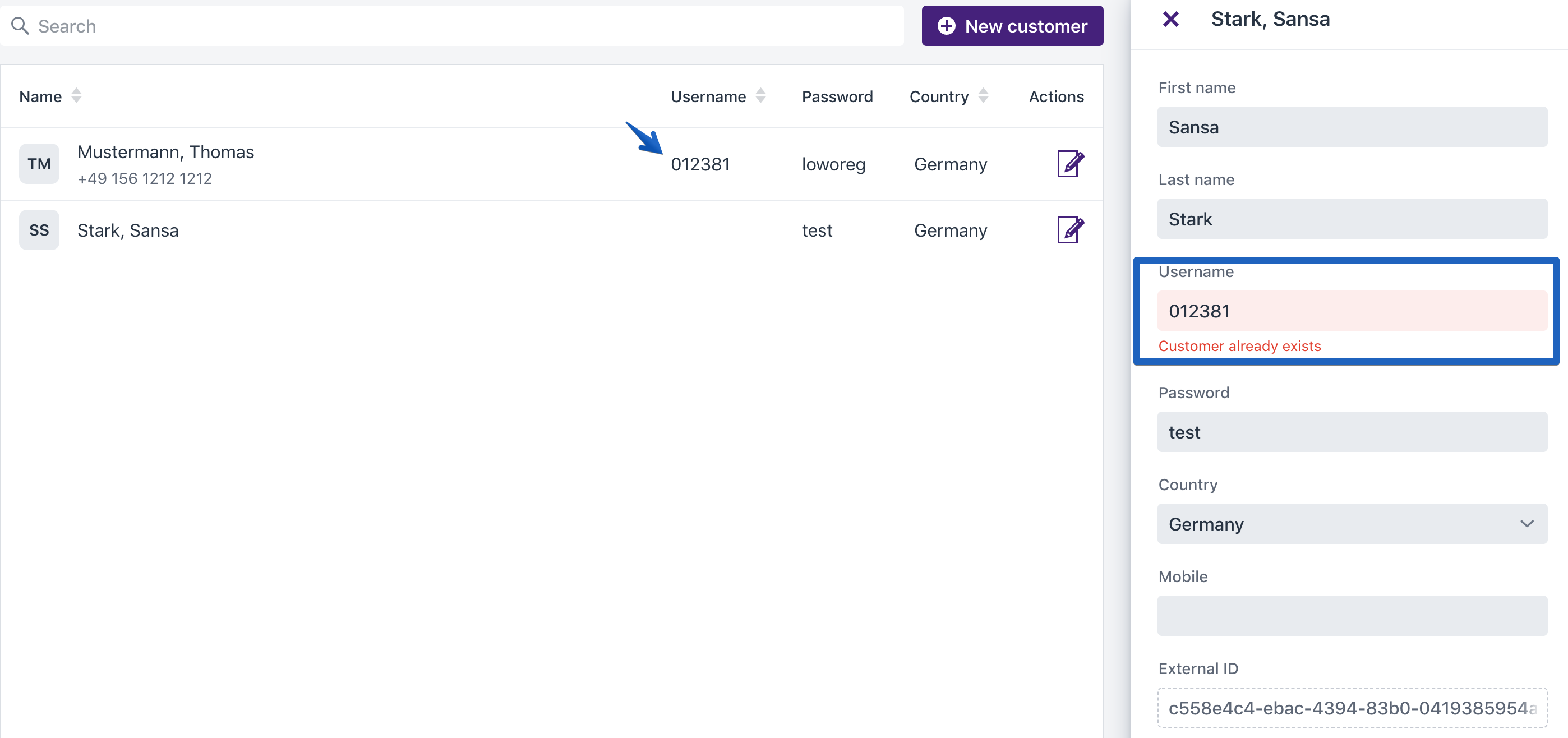

Selecting a customer (clicking once on it) will open the detail form on the right. You can edit customer’s data or delete him.

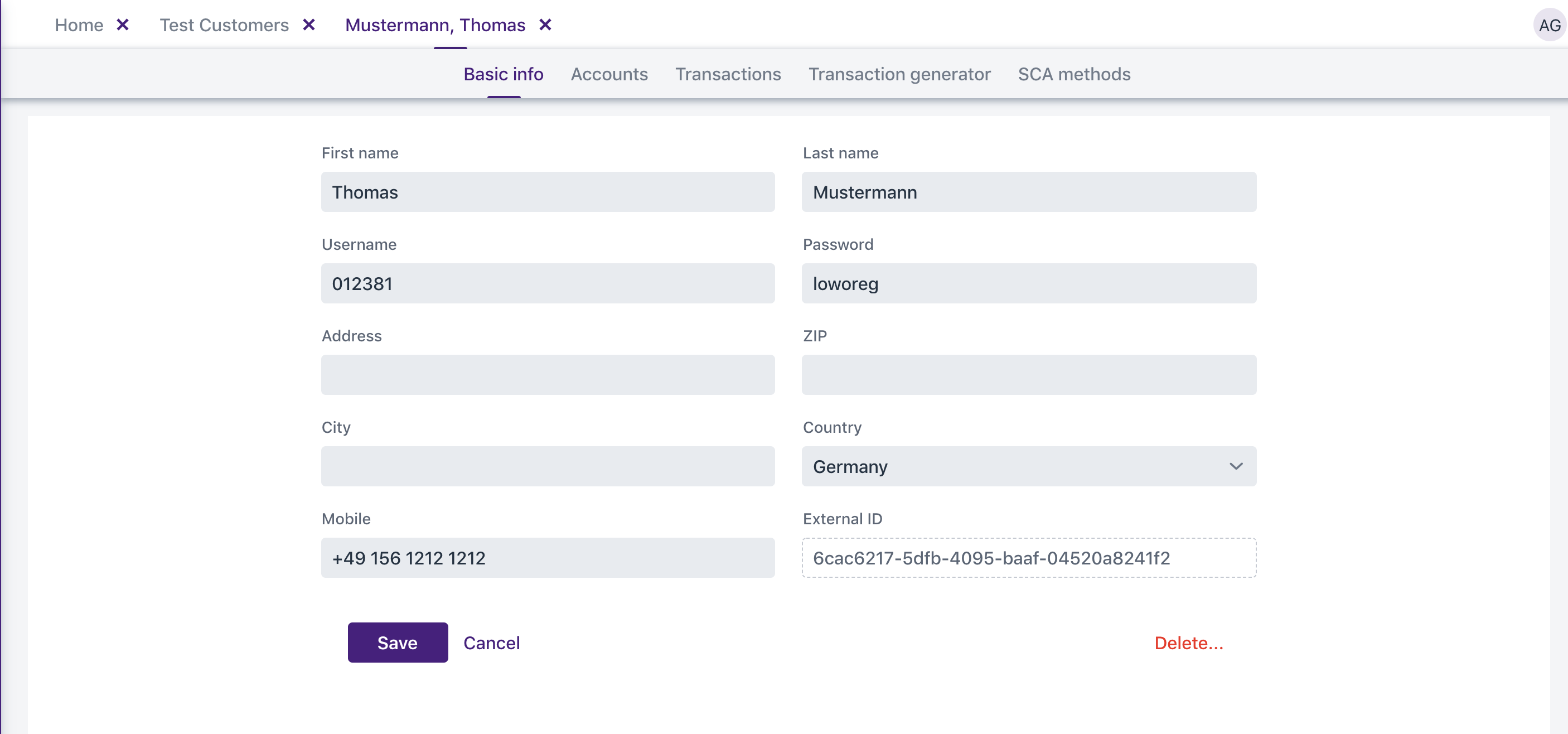

Double click or click on the “Edit“ Icon in customer’s list opens customer detail screen with all the customer’s attributes and related data: accounts, transactions and SCA methods.

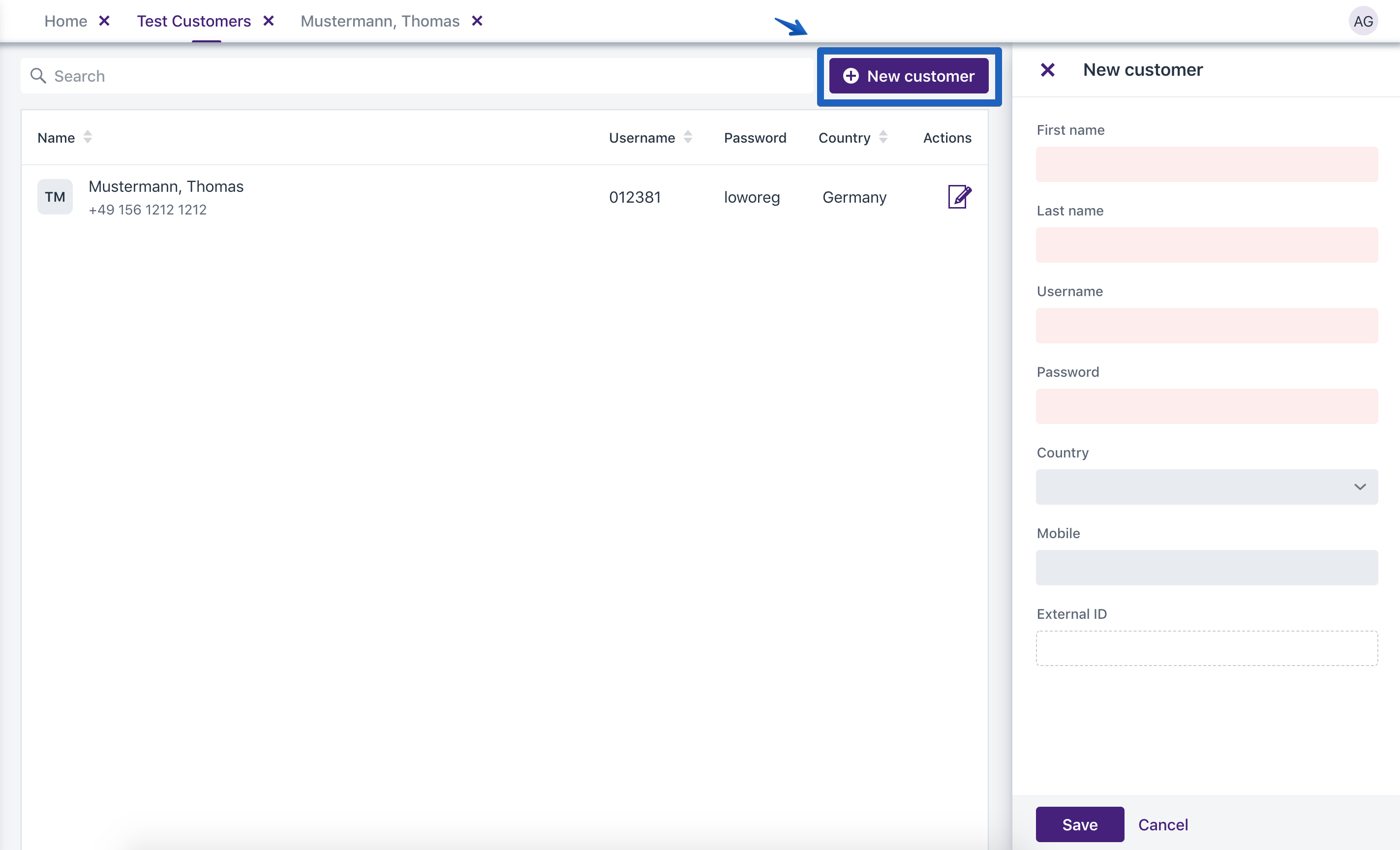

You can add a new customer from the customer list. An empty detail form appears on the right.

Please note username is unique across the system! When you create customer system will suggest a unique username for you. You can overwrite it, but it must remain unique across all customers of all organisations (not only yours). |

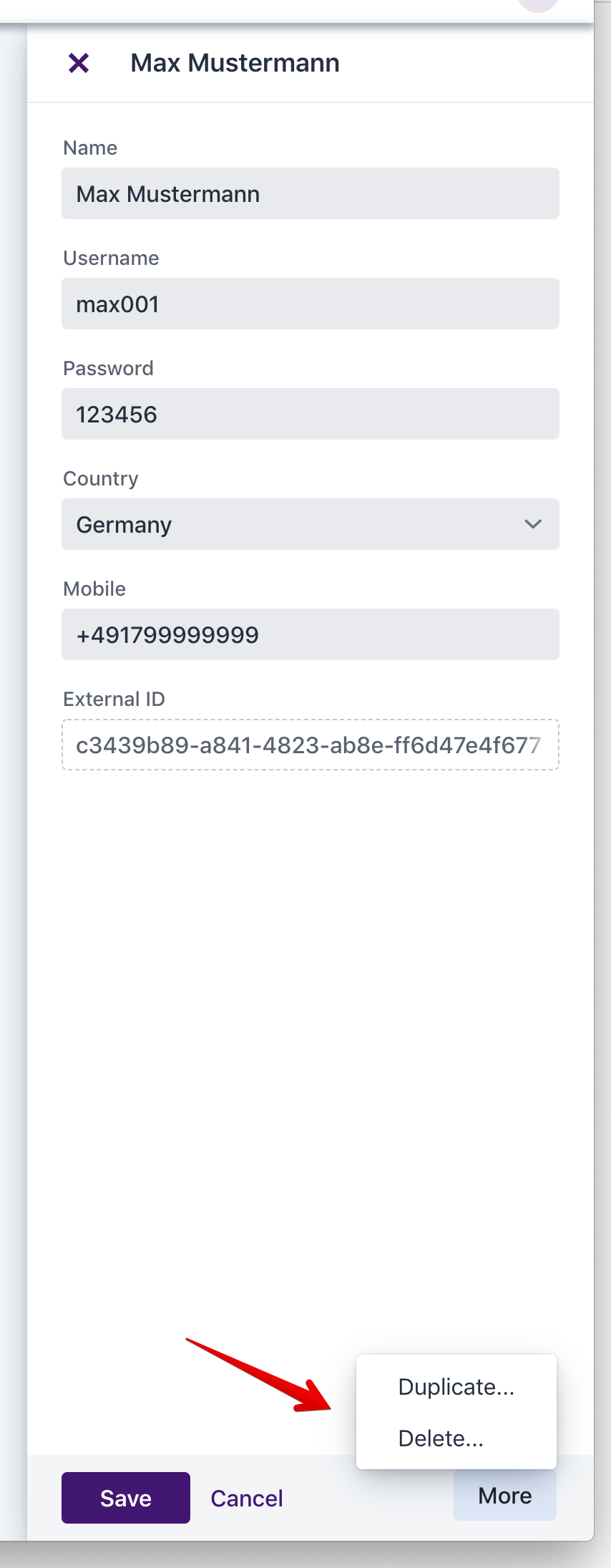

You can also duplicate (copy) customer.

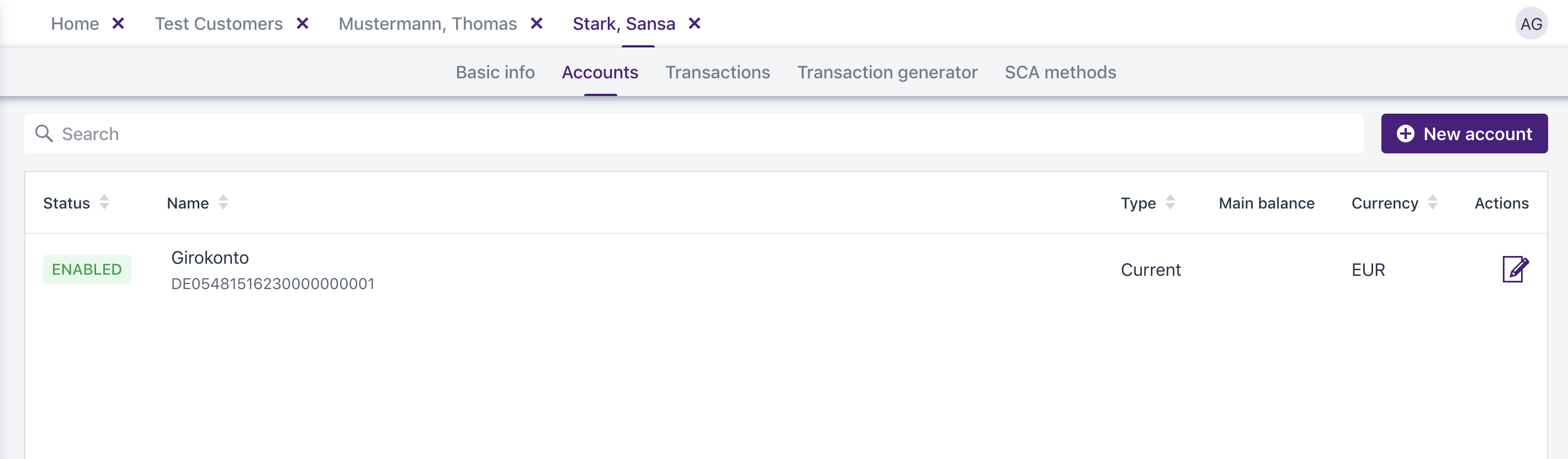

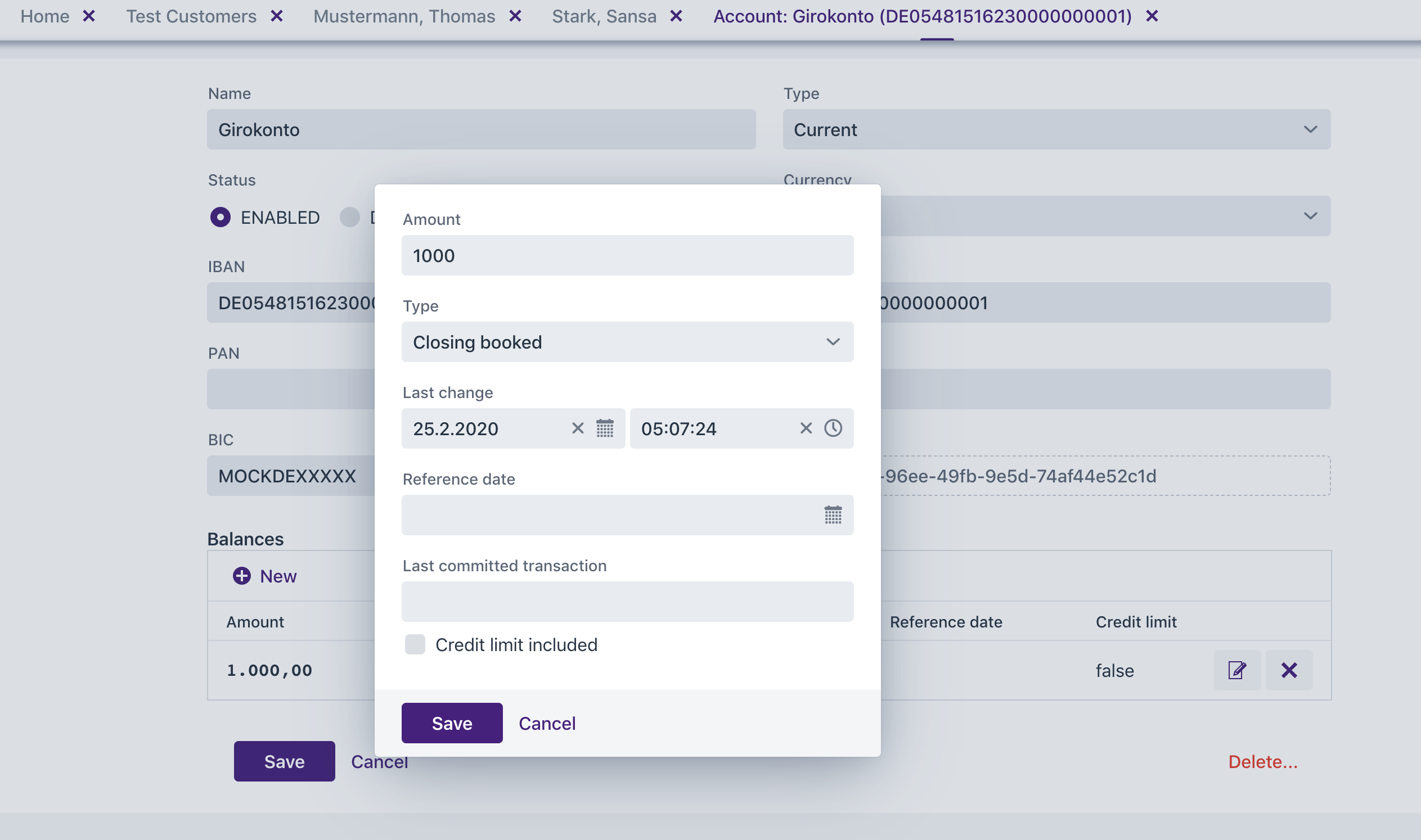

You can manage multiple accounts for a single customer.

Creating, editing and deleting accounts is similar to creating, editing and deleting customers.

IBAN must be unique across all customers in the system. When adding customer system will suggest an IBAN. You can overwrite it, but it must remain unique across all customers of all organisations (not only yours). |

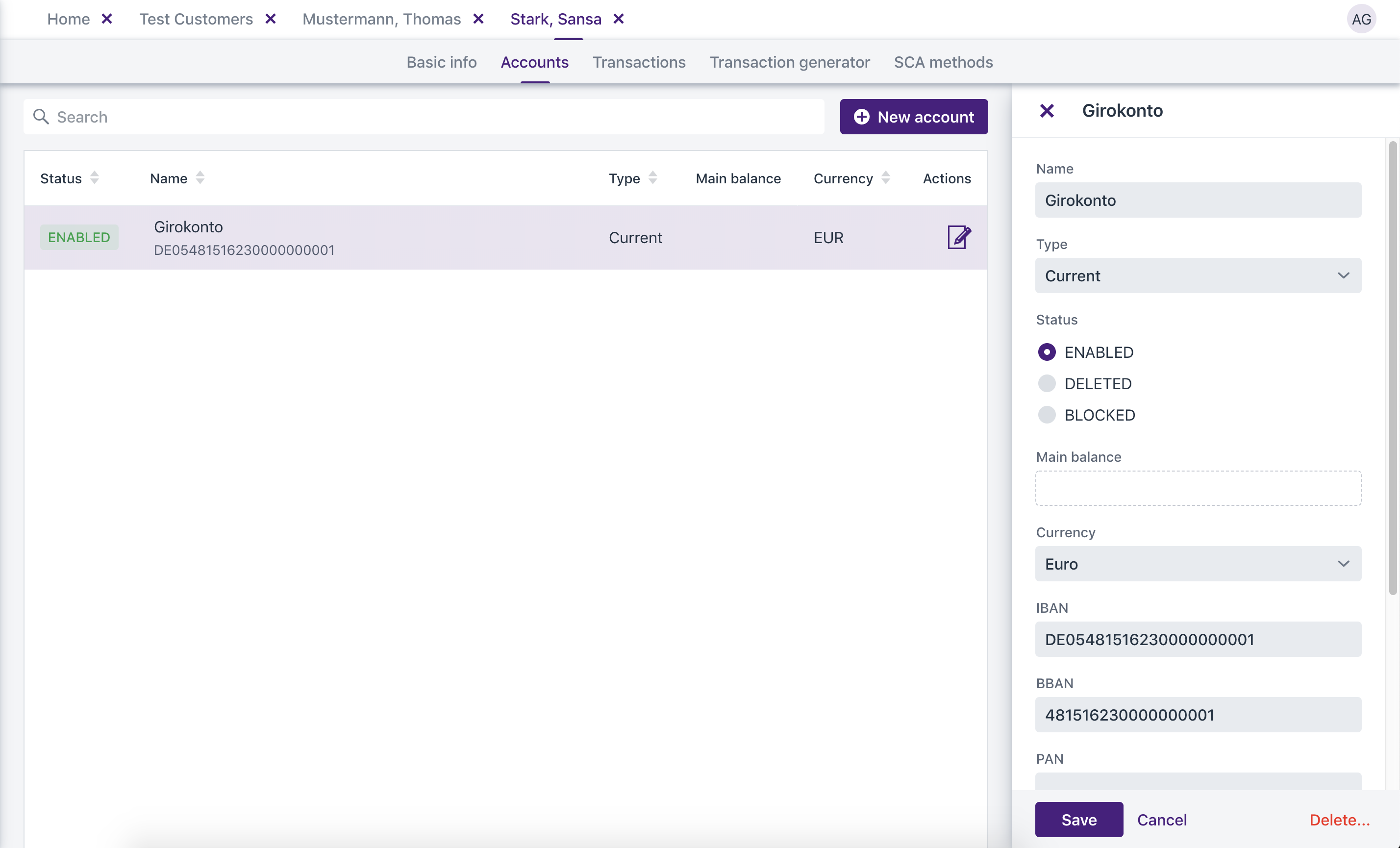

MockBank supports all account types mentioned in PSD2/Berlin group

It might be that your AISP has additional logic based on presence of a keyword in account name e.g. “Bausparkonto" or other fields (e.g. if MaskedPan is filled - it will be treated as CreditCard) - please refer to you AISP for more details.

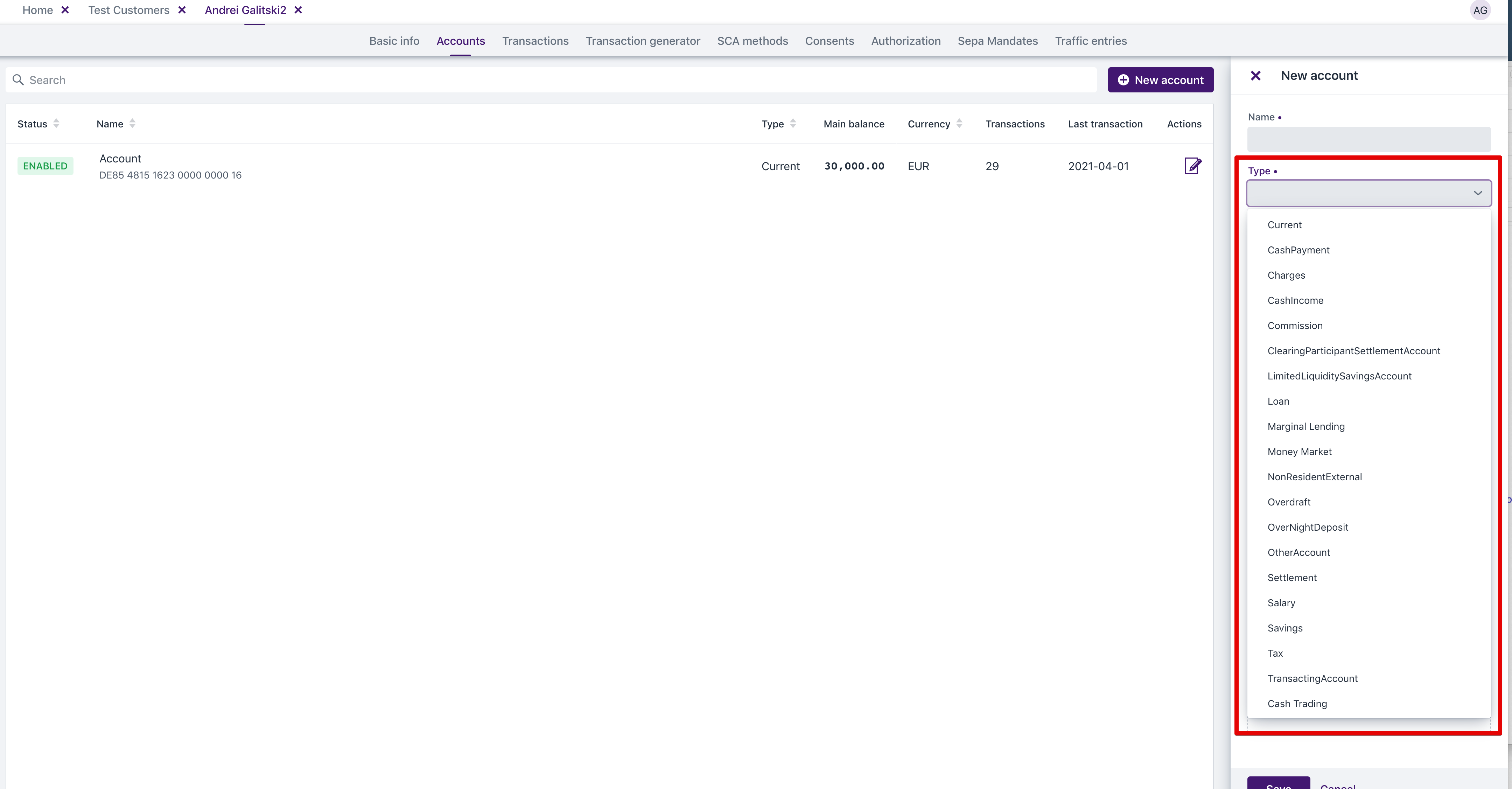

You can manage balances on the account detail screen.

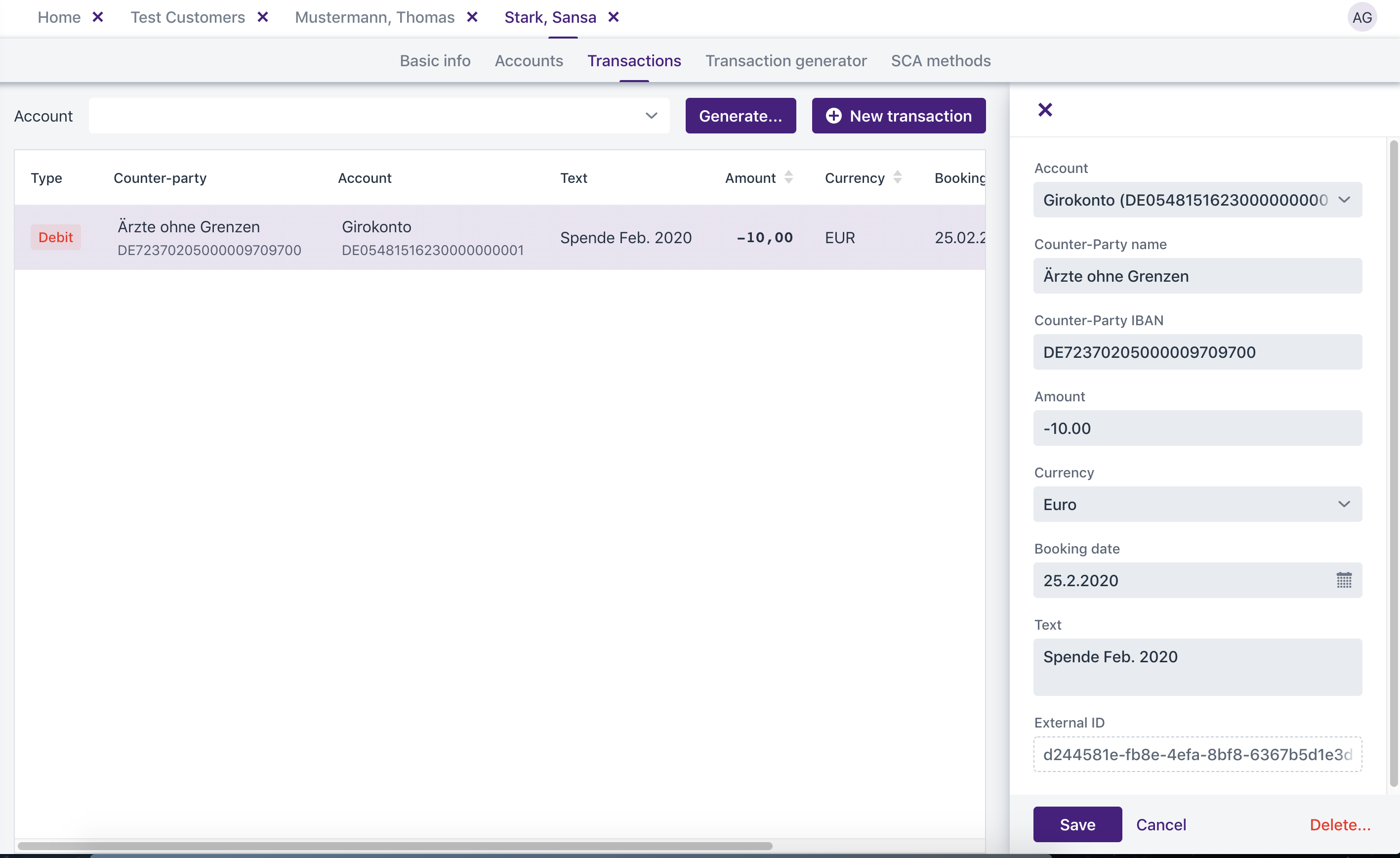

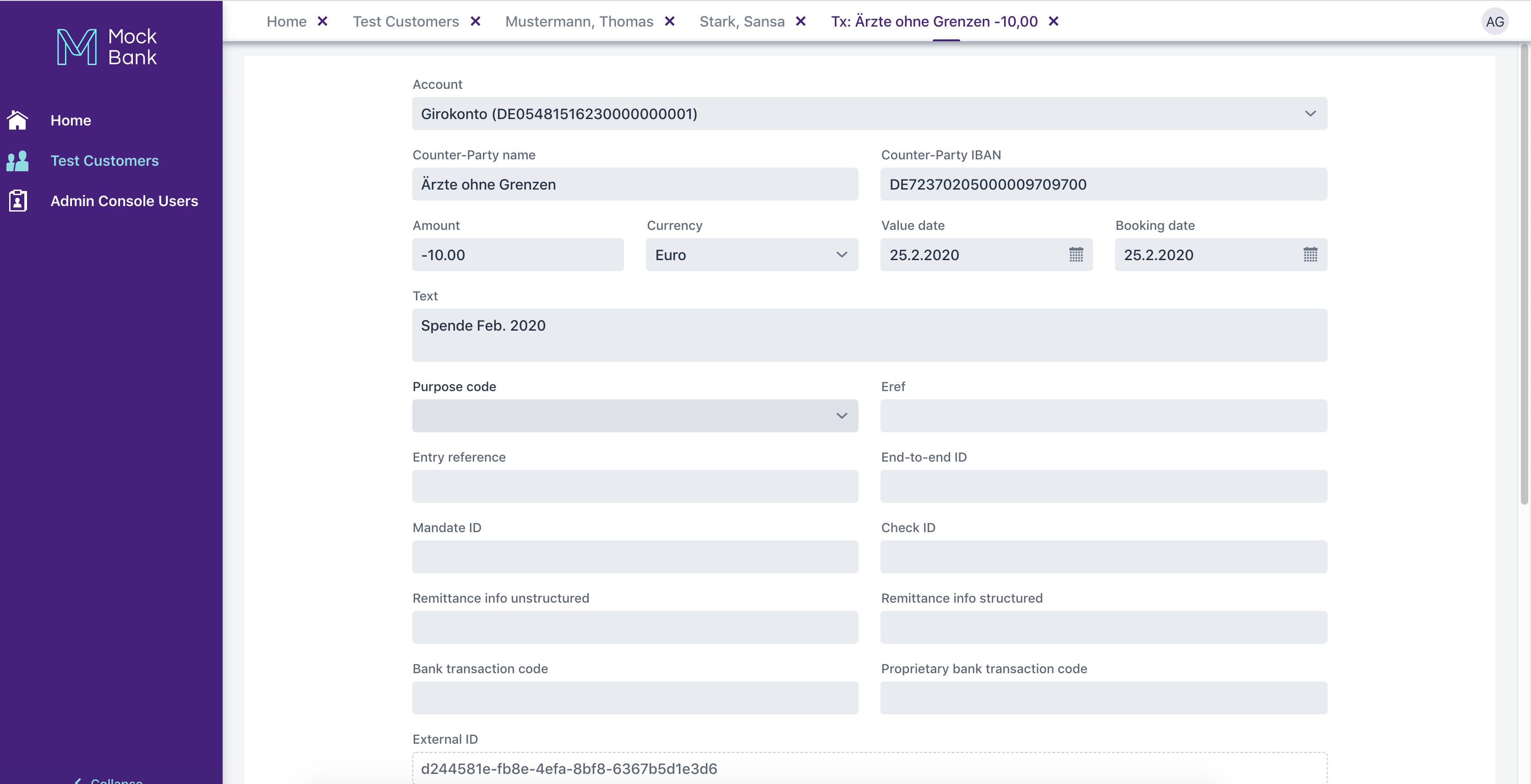

Managing transactions is similar to creating, editing and deleting customers and accounts.

The transaction detail screen has all the attributes specified by the PSD2 Berlin Group standard.

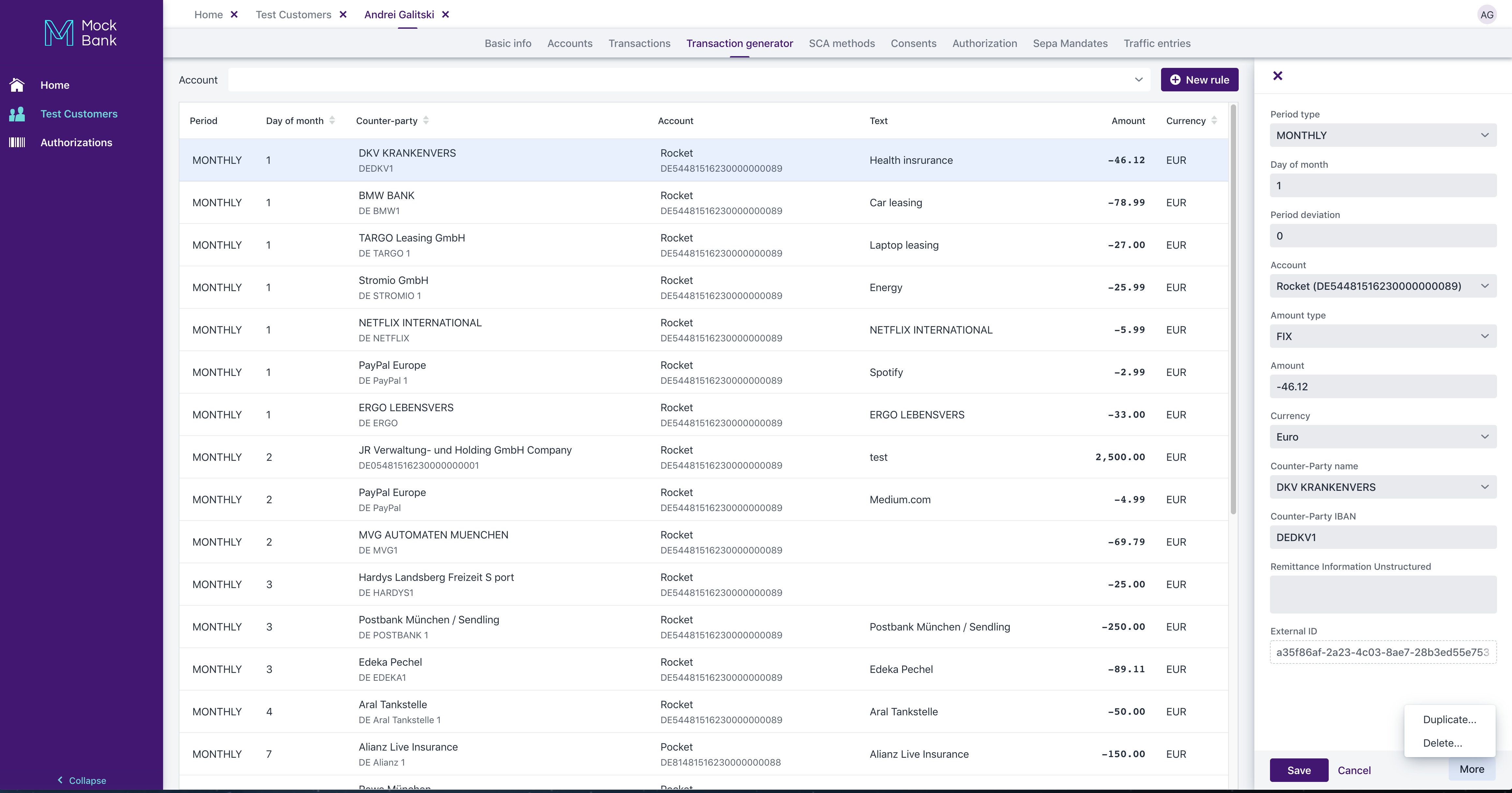

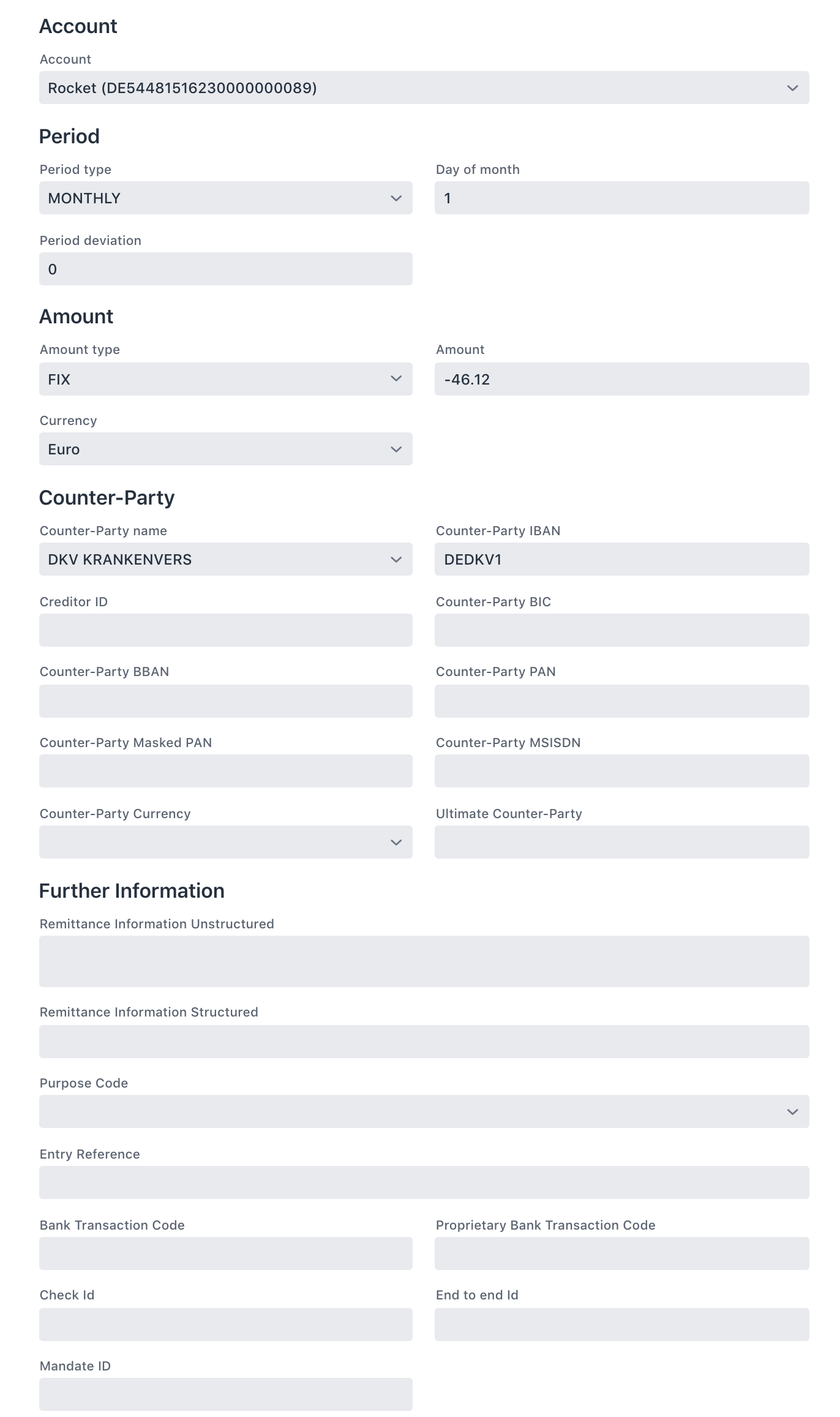

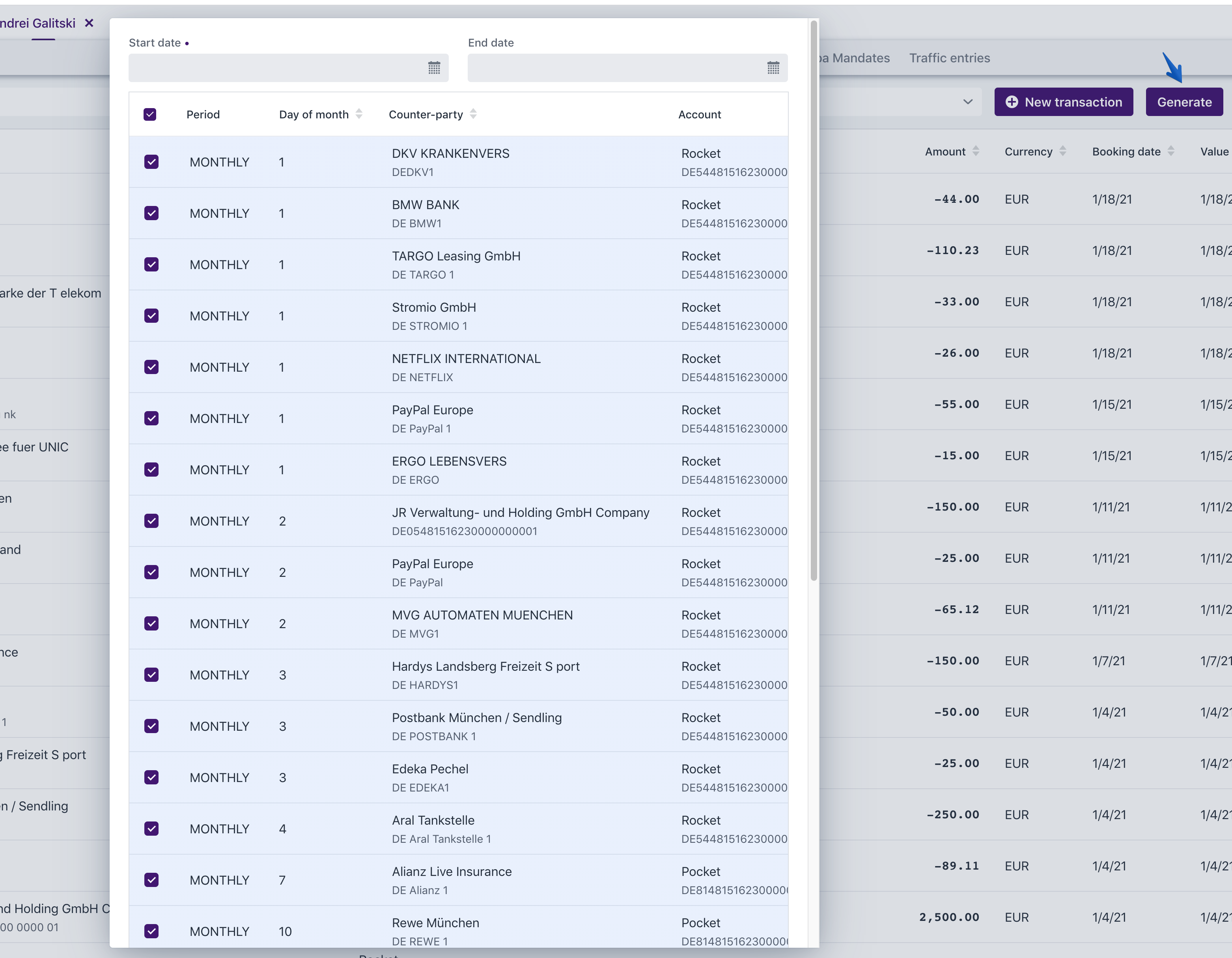

With the transaction generator you create rules that will help you generate multiple transactions for the customer. Transaction rule has the following fields:

Period: Monthly, Quarterly, Every 6 months, Yearly

Period Month (only for Quarterly, Every 6 months, Yearly) - a month of the period. E.g. with Quarterly, a value of “2" indicates 2d month of the quarter (February, May, August, November)

Day of month: which day of month transaction should be created on

Period deviation (in days): +/- days added to the date. E.g. 2 means that transaction date can be in range of [-2, +2] days to the date defined in the fields above.

Account: select customer’s account for the transaction

Amount type: FIX or Range

Amount: positive or negative amount for FIX type

Min. / Max. Amount (for Range): Range for the amount. Amount can be any number between min. and max.

Currency

Counter-Party name: Name for counter-party. Can be any string or you can select one of existing customers. In this case mirror transaction will appear on the counter-party transactions.

Counter-Party IBAN: as the counter-party name can be just as string or can point to an existing customers.

Remittance Information Unstructured: transaction text

Here’s transaction generator detail screen:

Once you have rules, you can manually generarte transactions for a given period of time.

If you fill out both dates then the transactions will be generated for the entire period.

if you just fill out a start date - transactions for that date will be generated.

Your can also choose what transactions should be used for generation.

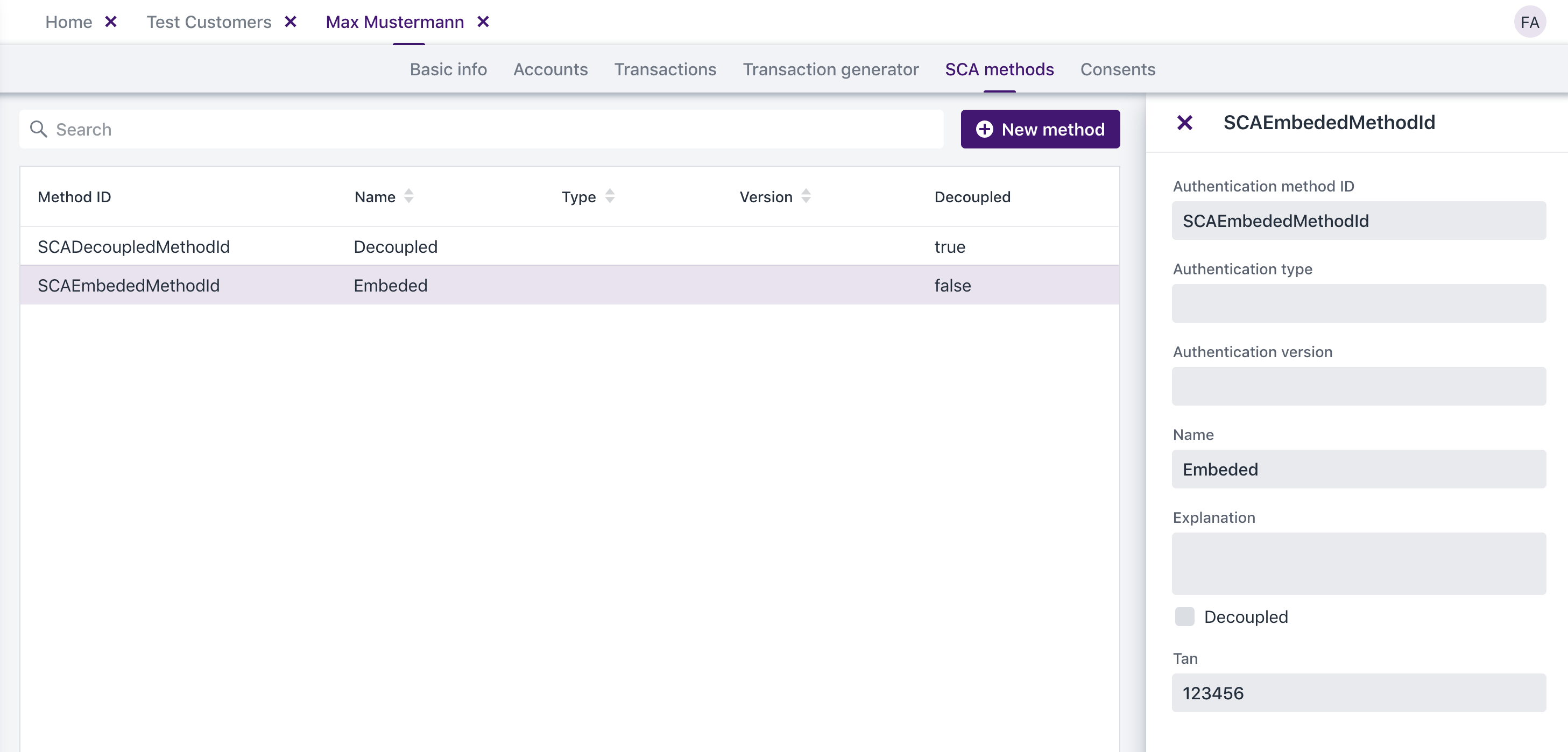

SCA Methods control strong customer authentication methods

If you have no methods configured for the customer the SCA will be skipped on the authentication workflow in the API.

if you have multiple SCAs configured you will have to choose the SCA method on the authentication workflow in the API.

If a decoupled flag is set - a decoupled approach will be used for the authentication workflow. Otherwise tan authentication is used.

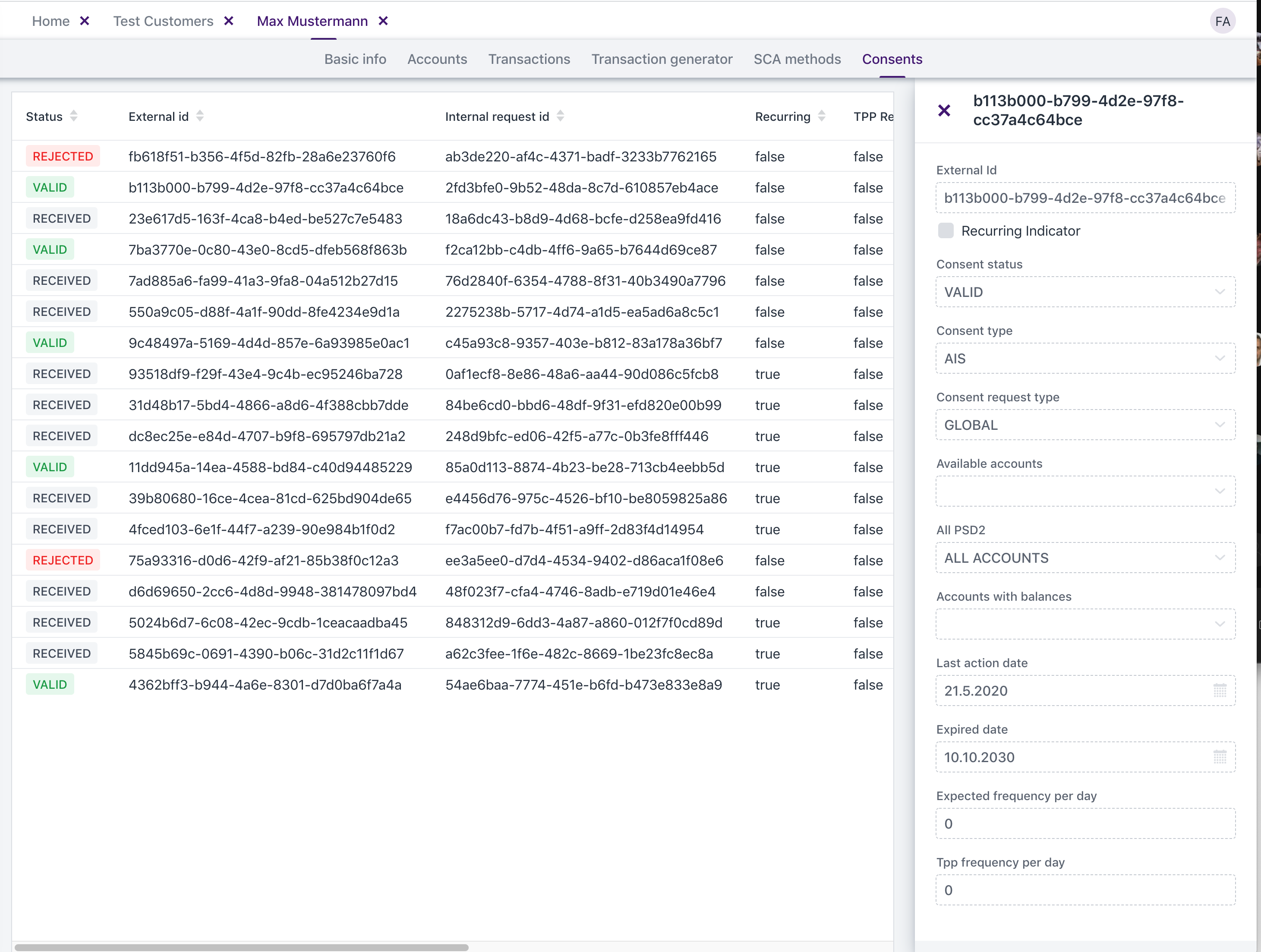

You can review all consents for the customer on the consents tab.